Tariffs have emerged as a central factor shaping the future of the global economy in light of escalating trade wars and mutual retaliatory measures between major economic powers. As we move deeper into 2025, the implementation of new tariffs and the intensification of existing ones present significant challenges to international trade, economic growth, and cooperation between nations. The current landscape of tariffs represents a dramatic shift from the decades-long movement toward free trade and globalization that characterized much of the post-World War II era. With the United States, China, and other major economies engaged in increasingly contentious trade relations, understanding the implications of these tariffs becomes crucial for businesses, policymakers, and citizens worldwide. This comprehensive analysis examines the current state of global tariffs, their economic impact, and what the future might hold for the international economic order.

Table of Contents

ToggleThe Fundamentals of Tariffs in Global Trade

Tariffs, at their core, are taxes imposed by governments on imported goods and services. They serve multiple purposes, from raising revenue for governments to protecting domestic industries from foreign competition. Historically, tariffs have been used as policy tools to shape economic relationships between nations and influence domestic production capabilities. In the context of the current global trade environment, tariffs have regained prominence as weapons in economic disputes rather than just revenue-generating mechanisms. The implementation of tariffs affects not only the direct trading partners but creates ripple effects throughout the global economy, influencing supply chains, consumer prices, and overall economic growth. The renewed focus on tariffs marks a significant departure from the trend toward free trade that dominated international economic policy for decades1. The strategic deployment of tariffs in today’s economic landscape reflects broader geopolitical tensions and nationalist economic policies that prioritize domestic interests over international cooperation and global economic integration.

The Escalating Trade War: Recent Developments and Implementations

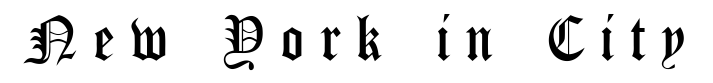

The trade war landscape has intensified dramatically in early 2025, with the United States implementing a significant wave of new tariffs that target multiple trading partners. Most notably, the U.S. has imposed a 25% tariff on goods from Canada and Mexico, which had been previously delayed from February 20252. Additionally, a 10% tariff has been applied to Chinese imports, marking just the first phase of planned tariff implementations for the year. The tariff schedule extends further with critical dates including March 12th, which saw the introduction of new steel and aluminum tariffs, and April 2nd, which expanded tariffs to cover automobiles, semiconductors, lumber, copper, and introduced reciprocal tariffs2. These measures represent a substantial escalation in trade tensions and signal a potentially more protectionist approach to international trade policy.

Strategic Targeting of Key Industries Through Tariff Policy

The current administration’s tariff strategy reveals a carefully targeted approach focusing on strategically important industries. On May 14, 2024, U.S. Trade Representative Katherine Tai announced new tariffs on $18 billion worth of Chinese imports, maintaining existing tariffs on over $300 billion worth of Chinese goods while adding new targeted measures4. The tariff increases are particularly significant in specific sectors, with electric vehicles facing a dramatic 100% tariff increase, while semiconductors and certain medical products seeing increases to 50%4. This strategic targeting of clean energy and semiconductor industries indicates a deliberate policy aimed at key technological and manufacturing sectors rather than a broad-based approach to tariffs. The selective nature of these tariff implementations demonstrates a sophisticated understanding of industrial policy and competitive advantage in the global marketplace, moving beyond simple protectionism to a more nuanced approach to economic competition.

Historical Context: Trade Wars Through the Decades

The current tariff tensions must be understood within a broader historical context. Since the 1980s, there has been consistent advocacy for stronger trade measures in the United States, particularly regarding perceived trade imbalances with international partners2. The 2018 China-U.S. trade war saw Washington impose tariffs ranging from 10% to 25% on four batches of Chinese export goods, many of which remain in effect today, with the average tariff rate on Chinese exports to the United States standing at 19%4. This historical perspective reveals that the current trade tensions are not entirely new but represent an intensification of long-standing concerns about fair trade practices, market access, intellectual property rights, and technology transfer. Understanding this continuity helps contextualize current policies and suggests that trade tensions may persist as structural features of the international economic system rather than temporary aberrations in an otherwise harmonious trading order.

Economic Impact Analysis: The Cost of Tariffs on Growth

The economic impact of tariffs is substantial and multifaceted. JPMorgan’s global research division has analyzed the potential consequences of recent tariff implementations, finding that they could increase inflation by 1% while reducing GDP by 0.7% for the current year, representing a 31% reduction from pre-tariff GDP expectations2. These figures align with broader academic research, which has found that tariff increases are associated with economically and statistically significant declines in output growth. Using aggregated annual data for 151 countries over 1963-2014, researchers found that a one standard deviation increase in tariff rates (3.6 percentage points) leads to approximately a 0.4% decline in output five years later3. The persistent nature of these effects is particularly concerning, as distorted price signals prevent the specialization that maximizes global productivity, leading to permanent losses in economic output if tariffs remain in place1. These findings substantiate fears that the ongoing trade war may indeed be costly for the global economy.

The Trillion-Dollar Question: Quantifying the Cost of a Global Tariff War

The potential global economic cost of the current trajectory of tariff escalation is staggering. A recent analysis by Aston University researchers estimates that the global cost of a 2025 tariff war could reach $1.4 trillion6. This comprehensive study is the first to estimate the economic fallout from six US trade tariff scenarios and their impact on trade flows, prices, production, and welfare. The analysis reveals differential impacts across countries, with immediate consequences for those directly targeted by US tariffs. Under initial US tariff scenarios, US prices rise by 2.7% while real GDP per capita declines by 0.9%, with welfare declines of 3.2% in Canada and 5% in Mexico6. The situation worsens under retaliation scenarios, with US losses deepening to 1.1%, Canadian welfare declining by 5.1%, and Mexican welfare declining by 7.1%6. The imposition of a 25% tariff on EU goods would lead to sharp transatlantic trade contraction and EU production disruptions. These figures highlight the interconnected nature of the global economy and the potentially devastating consequences of escalating trade tensions.

The Mechanics of Tariff Impact: From Border Taxes to Economic Decline

Tariffs impact economies through multiple channels. The estimated decline in output from tariffs appears to be related to several key mechanisms: reduced efficiency in the use of labor across sectors, appreciation of the real exchange rate which hampers competitiveness and undercuts possible improvements in the trade balance, higher imported input costs which raise production costs, and intertemporal effects as anticipated tariffs bring forward consumption and output, only to see these macro variables collapse once the tariff is actually imposed3. Additionally, monetary policy and financial market responses significantly influence the outcome of a trade war. The US federal funds rate may rise more quickly than baseline forecasts in response to higher domestic inflation, while increases in financial stress adversely affect new credit flows and restrain investment, industrial production, and trade1. Global equity prices are also expected to decline in a protectionist environment, adding another layer of economic challenge. These complex interconnections demonstrate why tariffs often have far-reaching consequences beyond their immediate revenue-generating or protectionist intentions.

Country-Specific Impacts: Winners and Losers in the Tariff Game

The impact of tariffs varies significantly across different economies. Countries imposing tariffs and countries subject to tariffs both experience losses in economic welfare, while countries on the sidelines experience collateral damage1. China and the United States have the most at stake in the current trade tensions, with both economies facing significant challenges. The US faces higher prices, reduced GDP growth, and potential disruptions to supply chains, while China faces reduced export opportunities and potential disruption to its export-oriented growth model. Canada and Mexico, as major trading partners with the US, face particularly severe welfare declines under the current tariff scenarios6. European economies face their own challenges, particularly if the US imposes 25% tariffs on EU goods, which would lead to sharp transatlantic trade contraction and production disruptions6. The varied impact across different economies highlights the complex and interconnected nature of global trade and the difficulty of predicting all consequences of tariff implementation.

Strategic Responses: How Nations Are Reacting to Tariff Escalation

Nations targeted by tariffs are developing strategic responses to mitigate their impact and potentially retaliate. China, for instance, has historically responded to US tariffs with countermeasures of its own, though current analysis suggests that a full-scale trade war may be avoided in the immediate term4. The EU, Canada, and Mexico are all considering or implementing retaliatory measures while also seeking diplomatic solutions through international forums such as the World Trade Organization. Some countries are exploring alternatives to tariff retaliation, including non-tariff barriers, strategic industrial policies, and the development of alternative trading relationships that reduce dependence on markets affected by tariffs. These varied responses reflect the complex calculations that nations must make when navigating trade tensions, balancing the desire to protect domestic industries and respond to perceived unfair practices with the economic costs of escalating trade conflicts and disrupting established trading relationships.

The Diplomatic Dimension: Negotiations and International Cooperation

Despite the escalation of tariffs, diplomatic efforts to resolve trade tensions continue. China and the United States, as the world’s two largest economies, have the most at stake, and it remains in their best interests to reach an agreement that addresses key issues such as market access, intellectual property rights, and joint-venture technology transfer1. International organizations like the World Trade Organization continue to provide forums for dispute resolution, though their effectiveness has been questioned in recent years. Regional trade agreements and bilateral negotiations offer alternative paths for maintaining open trade in the face of broader tensions. The diplomatic dimension of trade relations is crucial for understanding the future trajectory of tariffs and trade wars, as political considerations often outweigh purely economic calculations in determining trade policy. The potential for diplomatic breakthroughs remains, though the path to resolution appears increasingly challenging as tariffs become entrenched as policy tools.

Business Adaptation: Corporate Strategies in a Tariff-Heavy Environment

Businesses around the world are developing sophisticated strategies to navigate the challenges posed by tariffs. These adaptations include diversifying supply chains to reduce dependence on tariff-affected countries, relocating production to avoid tariffs, absorbing tariff costs to maintain market share, passing costs on to consumers, lobbying for exemptions or policy changes, and developing alternative markets to reduce exposure to tariff-affected trade routes. Companies are increasingly incorporating tariff considerations into their long-term strategic planning, recognizing that trade tensions may persist for years rather than months. The most successful adaptations tend to combine multiple approaches, maintaining flexibility in the face of changing tariff policies while building resilience against future trade shocks. The corporate response to tariffs represents a significant reorientation of global business strategy, with potentially lasting implications for patterns of production, investment, and trade.

Consumer Impact: How Tariffs Affect Prices and Purchasing Power

Tariffs ultimately affect consumers through multiple channels. Most directly, tariffs increase the prices of imported goods, reducing purchasing power and consumer welfare. The JPMorgan analysis suggests that the current wave of tariffs could increase inflation by 1%2, a significant impact that would be felt across consumer markets. Beyond direct price increases, tariffs can reduce consumer choice by making certain imported products uneconomical or unavailable. The impact is particularly pronounced for lower-income consumers, who spend a higher proportion of their income on goods and tend to have less flexibility to absorb price increases. The consumer impact of tariffs extends beyond immediate price effects to include reduced product variety, potential quality reductions as manufacturers adapt to cost pressures, and broader inflationary pressures that affect purchasing power across the economy. These effects demonstrate why tariffs, while sometimes politically popular, often face criticism from economists concerned with consumer welfare.

Sectoral Analysis: Industry-Specific Impacts of Tariff Policy

Different industries experience varying impacts from tariffs, depending on their exposure to international trade, ability to adjust supply chains, and strategic importance in national economic policy. The current tariff landscape reveals a focus on strategic industries, with particularly high tariffs on electric vehicles (100%), semiconductors (50%), and certain medical products (50%)4. These targeted approaches indicate policy goals beyond simple protectionism, aiming to shape the development of key industries for the future. Traditional manufacturing sectors like steel and aluminum continue to receive tariff protection, reflecting their political importance and historical vulnerability to international competition. Agricultural products, automobiles, and consumer electronics also face significant tariff impacts, with complex implications for producers, supply chains, and consumers. The varied impacts across sectors highlight the need for industry-specific analysis when assessing the consequences of tariff policies and developing appropriate business and policy responses.

Financial Market Implications: Tariffs, Currency, and Investment

Financial markets respond to tariffs through multiple channels, influencing currency values, investment flows, and asset prices. Trade tensions typically lead to increased market volatility as investors reassess risks and growth prospects. Currency markets are particularly sensitive to tariff announcements, with exchange rates adjusting to reflect changing trade balances and growth expectations. The real exchange rate appreciation associated with tariffs can hamper competitiveness and undercut possible improvements in the trade balance3, creating complex feedback loops in the relationship between tariffs and international financial flows. Global equity prices are expected to decline in a protectionist environment1, reflecting reduced growth expectations and higher uncertainty. Bond markets may see increased demand for safe-haven assets amid trade uncertainty, while simultaneously facing inflationary pressures from tariff-induced price increases. These financial market implications extend the impact of tariffs beyond immediate trade effects to broader economic and investment considerations.

The Innovation Question: Do Tariffs Help or Hinder Technological Progress?

The relationship between tariffs and innovation is complex and contested. Proponents of tariffs argue that protecting domestic industries can provide space for innovation and development of new technologies without overwhelming foreign competition. Critics counter that tariffs reduce competitive pressure and international knowledge spillovers that drive innovation, while increasing input costs for innovative firms. The current targeting of high-technology sectors like electric vehicles and semiconductors with elevated tariffs4 raises particular questions about the impact on global innovation in these crucial areas. The potential for tariffs to fragment global research and development networks, impede the flow of technical knowledge across borders, and reduce the scale of markets accessible to innovative firms presents significant challenges to technological progress. At the same time, domestic innovation policies paired with strategic tariffs could potentially nurture new industrial capabilities if properly designed and implemented. This tension highlights the need for nuanced analysis of the relationship between trade policy and technological innovation.

Historical Lessons: What Past Trade Wars Tell Us About the Present

Historical analysis of trade wars offers valuable insights into current tensions. The empirical evidence on the growth effects of import tariffs spans five decades of data from 150 countries, consistently showing that tariff increases are associated with economically and statistically significant declines in output growth3. The Smoot-Hawley tariffs of the 1930s, often cited as contributing to the depth and duration of the Great Depression, serve as a cautionary tale about the potential economic damage from escalating protectionism. More recent episodes, such as the 2018 US-China trade tensions, demonstrate the complex political economy of tariffs and the challenges of resolving trade disputes once they escalate. These historical perspectives suggest that while tariffs may serve short-term political objectives, they typically impose substantial economic costs and often fail to achieve their stated goals of improving trade balances or significantly increasing domestic employment in protected sectors. Learning from these historical experiences can inform more effective responses to current trade tensions.

Beyond Tariffs: Non-Tariff Barriers and Trade Policy Evolution

While tariffs have dominated recent trade policy discussions, they represent just one aspect of a broader landscape of trade measures. Non-tariff barriers, including regulatory requirements, licensing procedures, quotas, and technical standards, often play an equally significant role in shaping trade flows. As tariffs become more prominent, there is a risk of increased use of these less visible but equally impactful measures, potentially leading to further fragmentation of the global trading system. Additionally, investment restrictions, intellectual property policies, and digital trade regulations represent evolving areas of trade policy that may grow in importance as traditional tariff conflicts continue. The potential for trade policy to expand beyond conventional tariffs into these adjacent areas presents both challenges and opportunities for businesses and policymakers seeking to navigate an increasingly complex global trade environment. Understanding this broader context is essential for developing comprehensive strategies to address current trade tensions and build a more resilient international economic system.

Global Supply Chain Reconfiguration: The Lasting Legacy of Tariff Wars

One of the most significant long-term impacts of current tariff tensions may be the fundamental reconfiguration of global supply chains. The imposition of tariffs, combined with broader concerns about economic security and resilience, is accelerating trends toward regionalization, diversification, and in some cases reshoring of production. Companies are increasingly adopting “China plus one” or “China plus many” strategies to reduce exposure to US-China trade tensions, while also considering broader geographic diversification to mitigate risk4. These shifts have significant implications for investment patterns, employment distribution, and the economic development prospects of different regions. While some countries may benefit from production relocation, others may face challenges as established supply chain relationships are disrupted. The reconfiguration of global supply chains represents a structural change in the international economic order that may persist long after current tariff disputes are resolved, creating a lasting legacy of the current trade tensions.

The Path Forward: Policy Options for a Fractured Trading System

As the global economy navigates these complex trade tensions, several policy options emerge for addressing the challenges posed by tariffs and rebuilding a more functional trading system. These include renewed multilateral cooperation through reformed international institutions, bilateral and regional trade agreements that maintain open trade within smaller groups of countries, targeted industrial policies that address legitimate concerns about critical industries without resorting to broad tariffs, and domestic policies that better distribute the benefits of trade and support those adversely affected by international competition. The probability of an all-out trade war, while still relatively low, is increasing1, highlighting the urgency of finding effective policy responses. The most promising approaches likely combine elements of all these strategies, recognizing both the legitimate concerns that have driven the recent turn toward tariffs and the substantial economic costs that excessive protectionism imposes. Building a more resilient and inclusive trading system requires acknowledging the complex political economy of trade policy while working toward solutions that maximize global economic welfare.

Conclusion: Navigating the Future of Tariffs and Global Trade

The future of the global economy in light of trade wars and mutual tariffs remains uncertain but critically important. The analysis presented here suggests that the economic costs of tariff escalation are substantial, with potential global losses reaching $1.4 trillion in a 2025 tariff war scenario6. These costs are distributed unevenly across countries and sectors, creating complex challenges for policymakers, businesses, and consumers. Despite these challenges, opportunities exist for diplomatic solutions, business adaptation, and policy innovation that could mitigate the worst potential outcomes. The current tariff landscape reflects deeper tensions in the global economic order regarding fairness, sustainability, security, and the distribution of benefits from international trade. Addressing these underlying issues will be essential for building a more stable and equitable trading system. As the world navigates this period of trade tension and tariff implementation, the decisions made by governments, businesses, and international institutions will shape the global economy for decades to come. The stakes are high, but so too is the potential for constructive solutions that harness the benefits of international trade while addressing legitimate concerns about its impacts.